Condo Insurance in and around Sandy

Townhome owners of Sandy, State Farm has you covered.

State Farm can help you with condo insurance

Your Search For Condo Insurance Ends With State Farm

Looking for a policy that can help insure both your condo and the pictures, cookware, appliances? State Farm offers excellent coverage options you don't want to miss.

Townhome owners of Sandy, State Farm has you covered.

State Farm can help you with condo insurance

Put Those Worries To Rest

Everyone knows having condominium unitowners insurance is essential in case of a tornado, blizzard or hailstorm. Adequate condo unitowners insurance can help if your condo is destroyed, so you aren’t stuck making payments for a home you can’t live in. Another valuable component of condo unitowners insurance is that it also covers you in certain legal cases. If someone is injured due to your careless error, you could be on the hook for their medical bills or their lost wages. With adequate condo coverage, you have liability protection in the event of a covered claim.

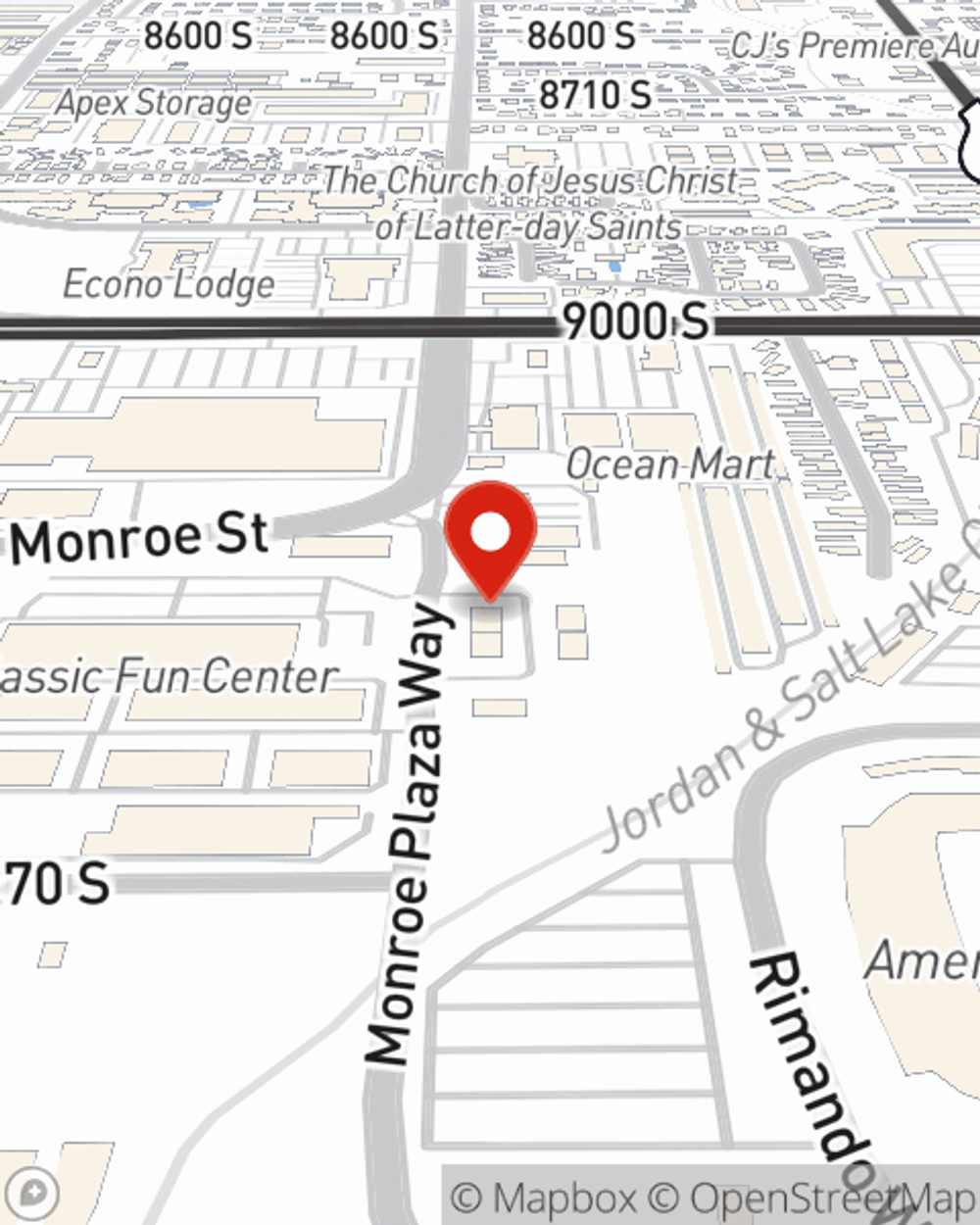

There is no better time than the present to visit agent Paul Dubbs and explore your condo unitowners insurance options. Paul Dubbs would love to help you select the smartest policy for you.

Have More Questions About Condo Unitowners Insurance?

Call Paul at (801) 566-5111 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.