Business Insurance in and around Sandy

Looking for small business insurance coverage?

This small business insurance is not risky

This Coverage Is Worth It.

When experiencing the highs and lows of small business ownership, let State Farm be there for you and help provide terrific insurance for your business. Your policy can include options such as a surety or fidelity bond, extra liability coverage, and worker's compensation for your employees.

Looking for small business insurance coverage?

This small business insurance is not risky

Protect Your Future With State Farm

Your company is special. It's where you make your living and also how you grow your life—for yourself but also for your loved ones, and those who work for you. It’s more than just a shop or earning a paycheck. Your business is part of who you are. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers a plethora of occupations like an acupuncturist. State Farm agent Paul Dubbs is ready to help review coverages that fit your business needs. Whether you are a pharmacist, a sporting goods store or a plumber, or your business is a travel agency, a dance school or a shoe repair shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Paul Dubbs understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call Paul Dubbs today, and let's get down to business.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

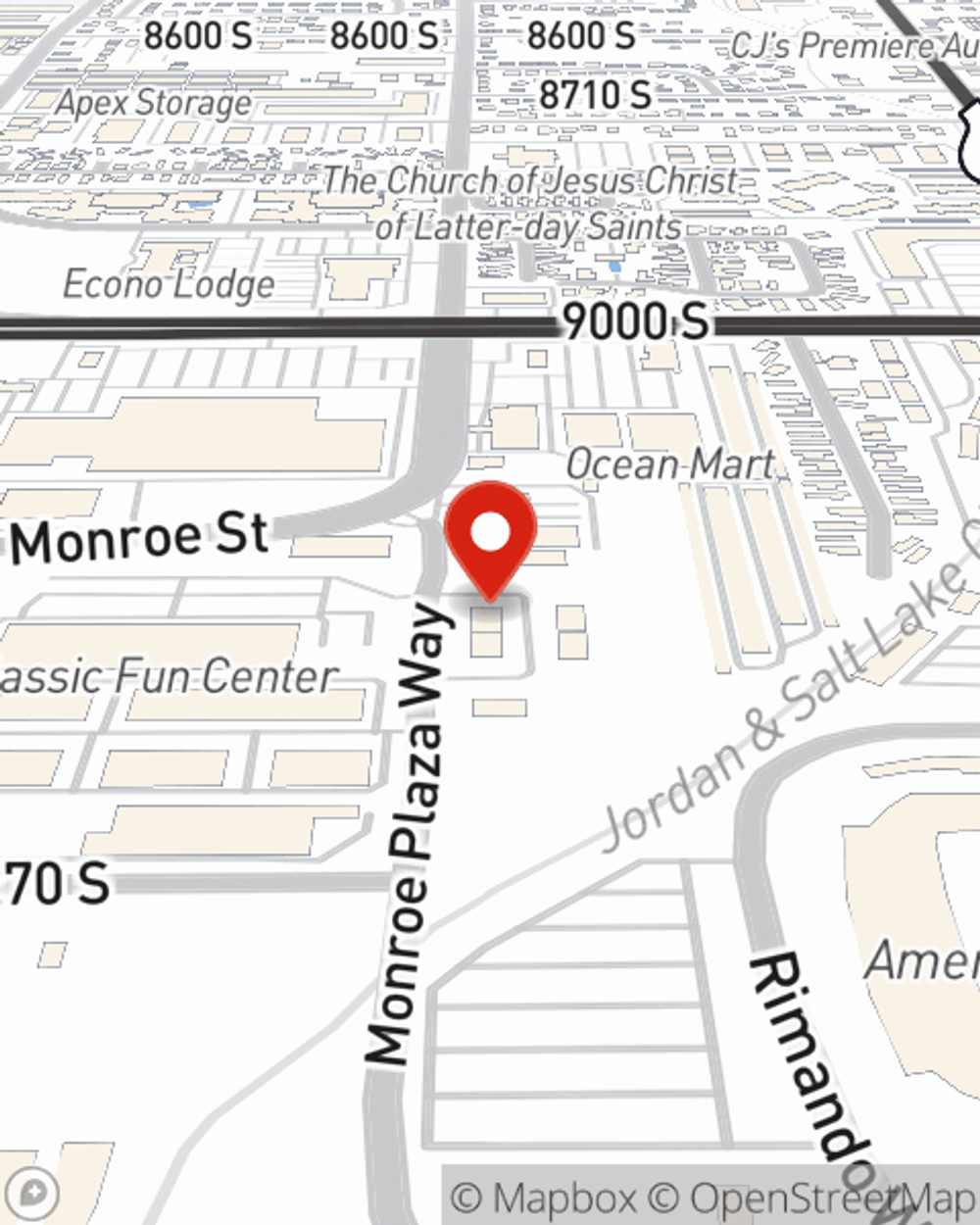

Paul Dubbs

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.